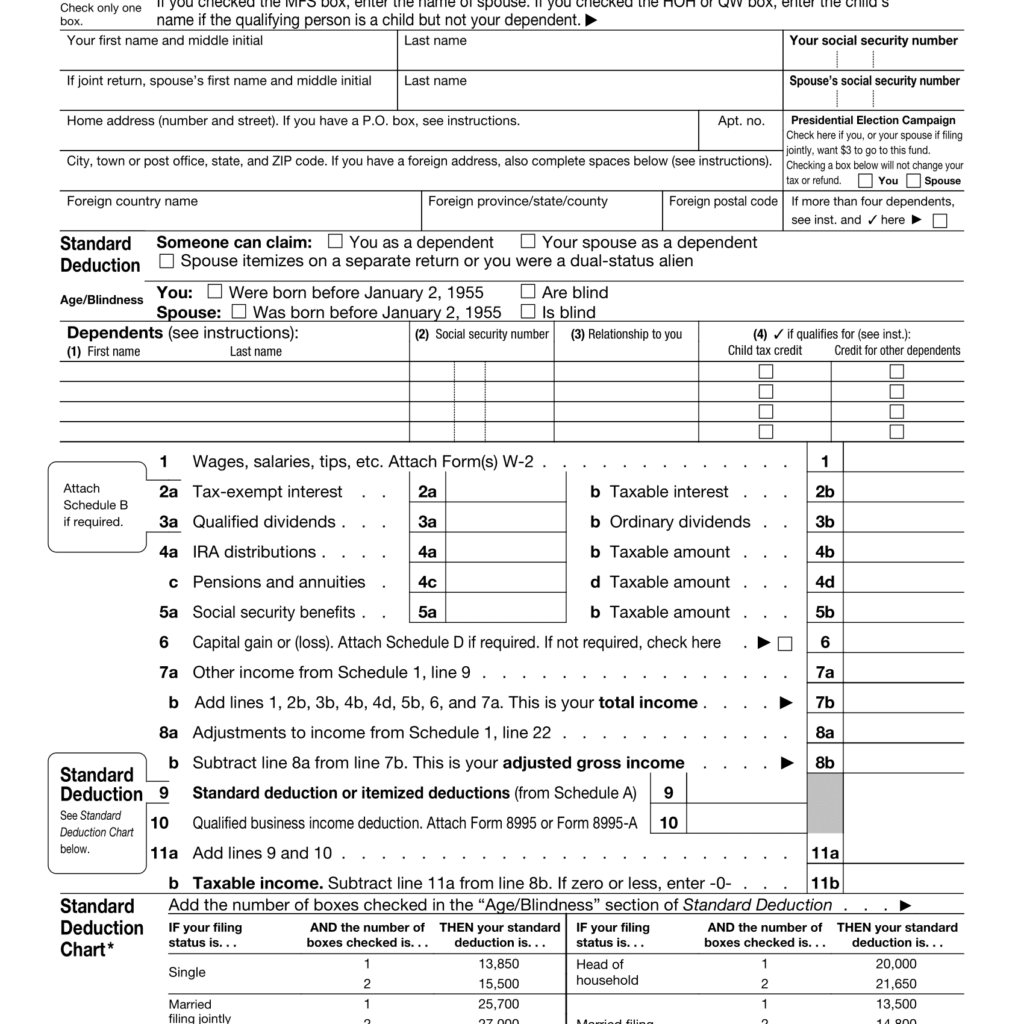

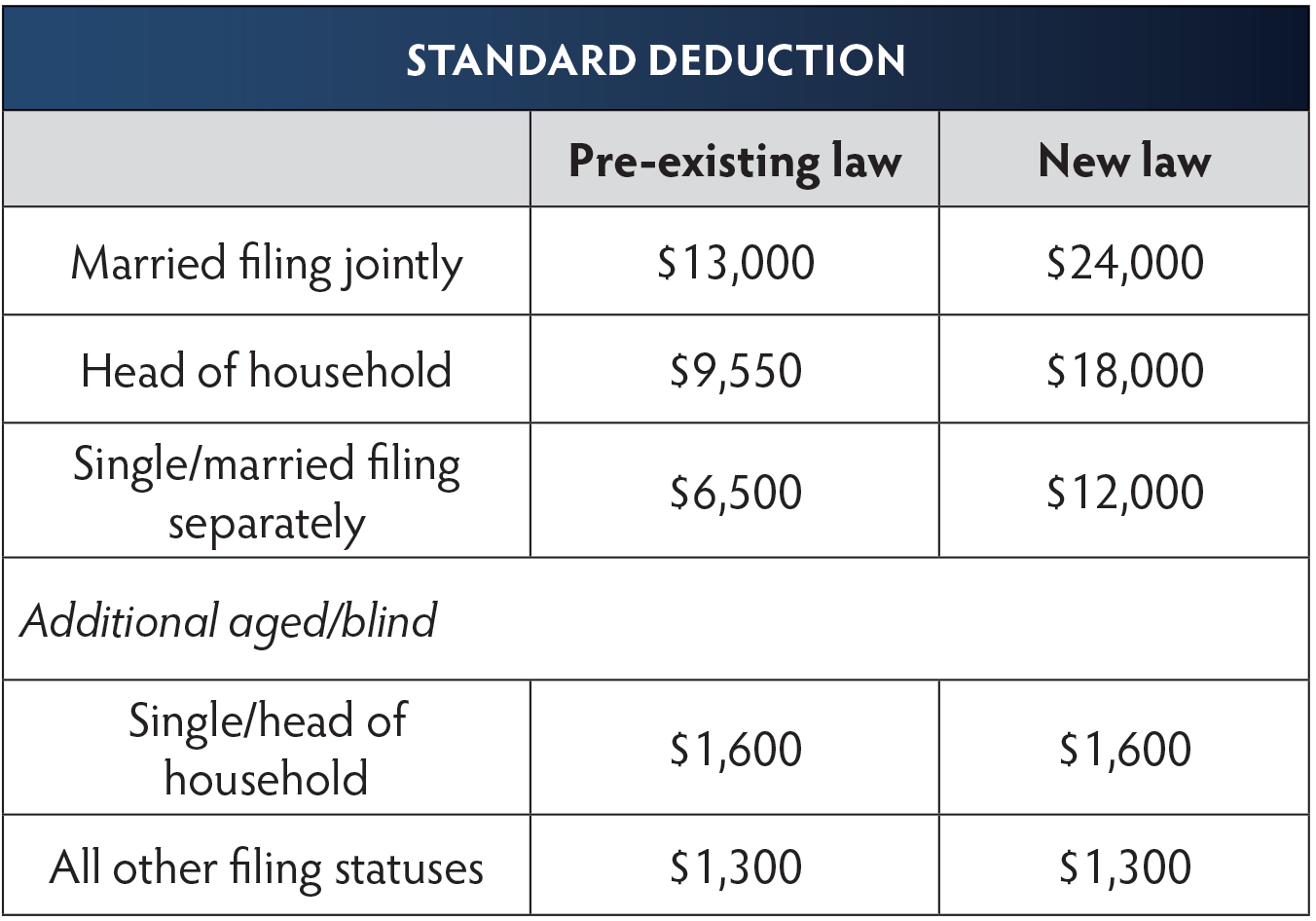

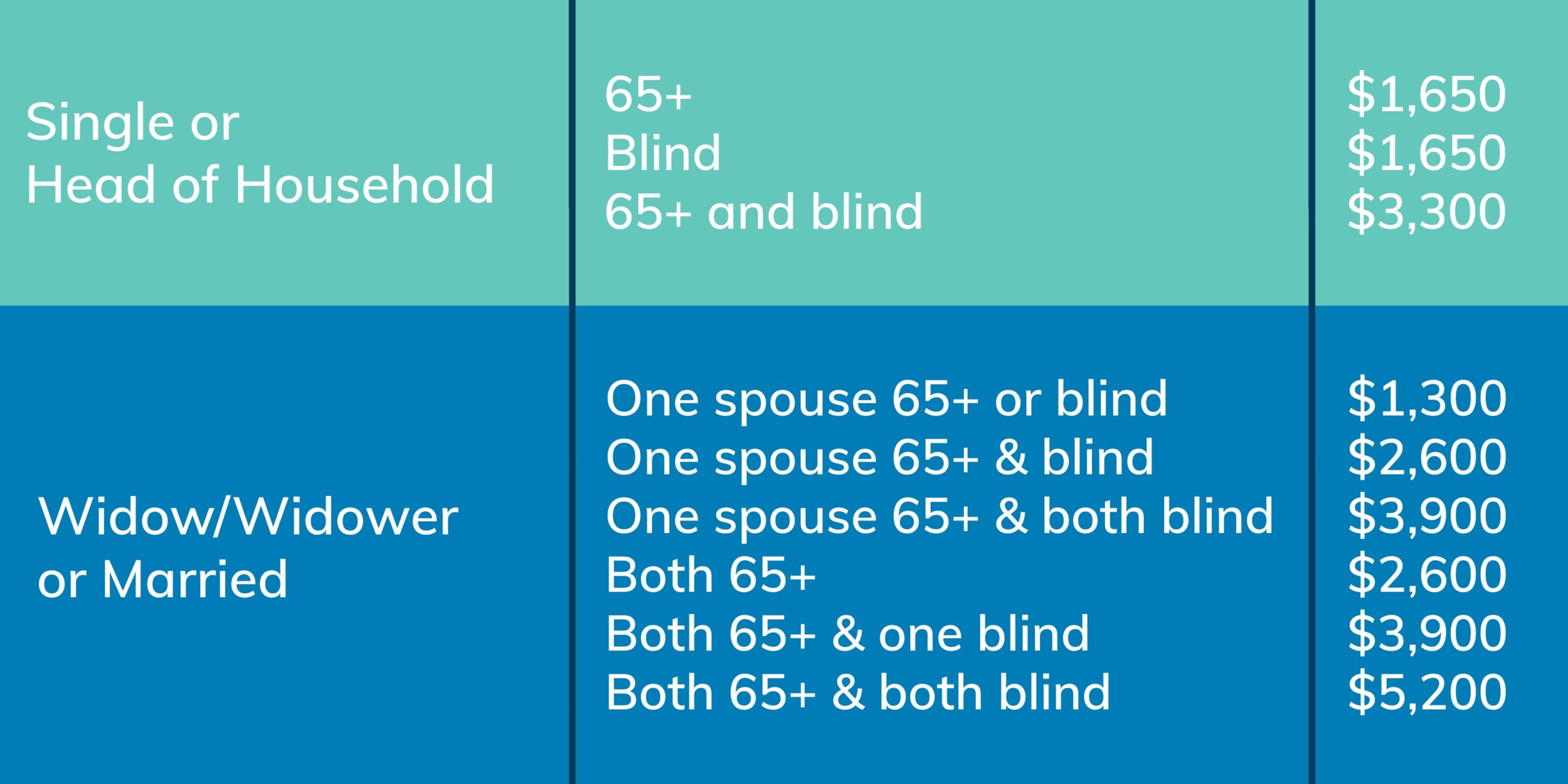

Irs Standard Deduction 2025 Over 65 Years - Unveiling IRS Standard Deductions for 2025 Everything You Need to Know, 2025 standard deduction over 65. Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers. The federal federal allowance for over 65 years of age married (joint) filer in 2025 is $ 1,550.00.

Unveiling IRS Standard Deductions for 2025 Everything You Need to Know, 2025 standard deduction over 65. Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers.

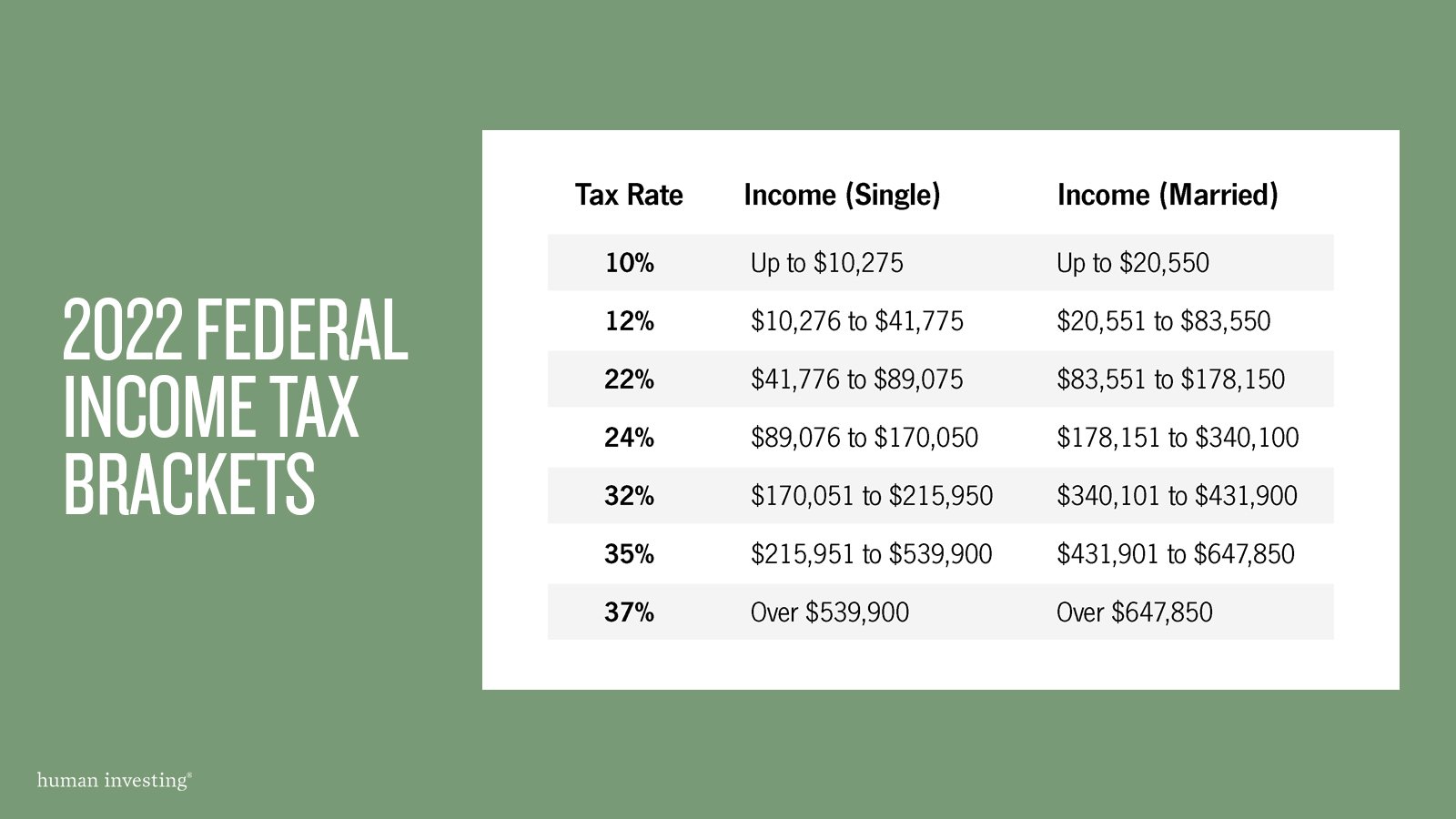

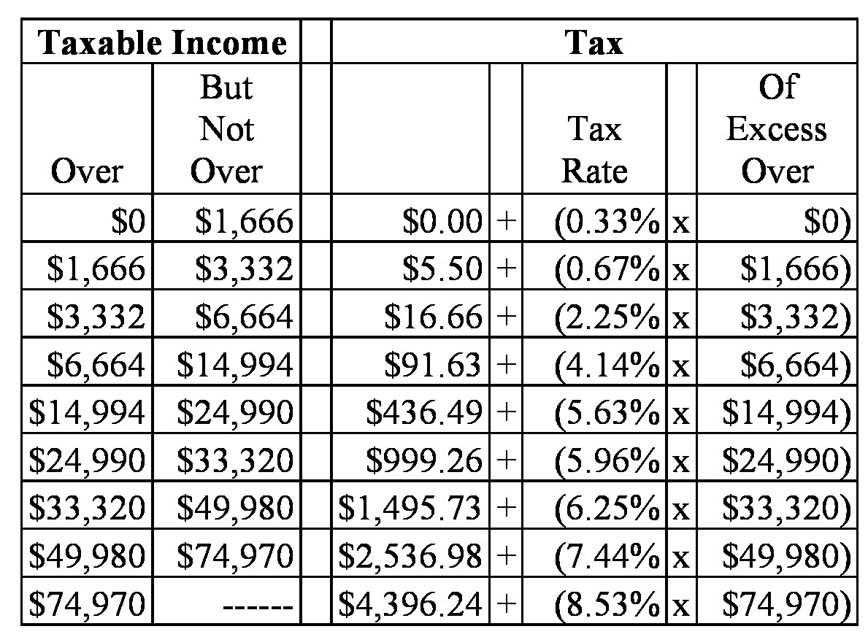

Federal Tax Rate Chart 2025 Patti Andriette, The standard deduction for those over age 65 in tax year 2023 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or. Tax brackets 2025 irs single elana harmony, the.

.jpg?width=3333&name=tax graphic_2020 (1).jpg)

Godzilla And Kong 2025 Villain Name. The final stage of marketing has revealed the new […]

2025 Standard Deduction Over 65 Tax Brackets Elvira Miquela, However, you would have to itemize in order to take this deduction. You can also itemize individual tax deductions, for things like charitable.

Standard Deduction 2025 Over 65 Standard Deduction 2025, Irs announces 2025 tax brackets, updated standard deduction. For 2025, the additional standard deduction amount for the aged or the blind is $1,550.

2025 Standard Deduction Over 65 Standard Deduction 2025, $3,700 if you are single or filing as head of household. The standard deduction for those over age 65 in tax year 2023 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or.

2025 Standard Deduction Age 65 Nara Leonie, Page last reviewed or updated: Property tax deduction california 2025.

When Can I File My Taxes For 2025 Irs Britta Kandace, You can also itemize individual tax deductions, for things like charitable. $3,700 if you are single or filing as head of household.

Tax Year 2025 Standard Deduction Over 65 Dina Myrtia, If you are 65 or older and blind, the extra standard deduction is: Failing to pay taxes owed by april 15, 2025.

Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers.

Irs Standard Deduction 2025 Over 65 Years. You can also itemize individual tax deductions, for things like charitable. The standard deduction for those over age 65 in tax year 2023 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or.